Thursday, February 1st, 2024

Last week, Visa reported its earnings for Q1 2024 (spanning calendar Q4 2023), while this week Mastercard reported its earnings for Q4 and full year 2023 results.

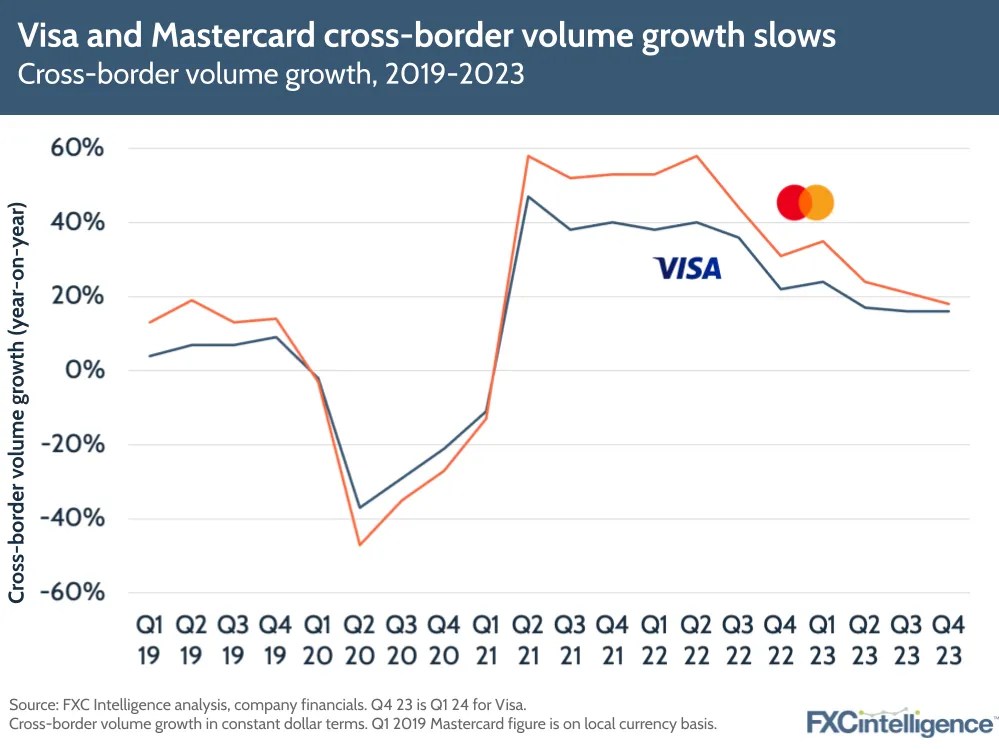

Both companies continue to see rising cross-border volumes, albeit at a slower pace than the same period in previous years, though Mastercard noted that cross-border travel continued to be impacted by tougher comparisons to the post-Covid recovery of the sector last year.

Some of the main cross-border related highlights from the earnings for both companies are included below:

Visa Q1 2024 highlights

- Net revenues rose by 9% to $8.6bn, driven by cross-border volumes (excluding intra-Europe) rising 16% YoY in constant dollar terms. US payments volume grew 5% YoY, while international payments volume grew 11%.

- Cross-border volumes were aided by a 142% rise in cross-border travel compared to 2019 levels. In total, the company now enables global payments across 8.5 billion endpoints in nearly 200 countries and territories.

- Visa Direct transactions grew by around 20% to 2.2 billion, with P2P cross-border transactions growing by 65% YoY. International transaction revenues rose by 8% YoY to $3bn, compared to a 29% growth in Visa’s Q1 2023.

- Visa has formed a number of new partnerships, including with Western Union, Remitly, CIBC, Simplii and HSBC’s Zing, to help these companies expand their remittances capabilities.

Mastercard Q4 2023 and FY 2023 highlights

- In Q4, net revenues rose by 13% to $6.5bn, which the company attributed to a 9% rise in payment network revenues, 18% cross-border volume growth and 12% growth in switched transactions.

- Mastercard also saw 19% net revenue growth in value-added services and solutions, driven by its cybersecurity products. Adjusted operating margin improved to 56.2% in Q4.

- In Q4, cross-border assessments – the charges based on activity related to cards bearing the Mastercard brand where the merchant country and the country of issuance are different – rose by 23% to $2.2bn .

- Spanning Mastercard’s full year, net revenues rose by 13% to $25.1bn, driven by a 10% rise in payment network net revenues, 24% growth in cross-border volumes and 14% growth in switched transactions.

- Mastercard continues to advance its Cross-Border Services platform, with a number of new and expanded partnerships, including with UBS, Alipay, Arab Bank and Dubai Islamic Bank.

Joe is a Senior Copywriter at FXC Intelligence, writing and editing reports, news and analysis to support the company’s weekly content and client projects. Before joining FXC Intelligence, he worked as a B2B copywriter, journalist and editor covering a broad range of topics, including technology, transport, retail and the food and beverage industries. He has a BA in Philosophy from the University of Warwick.