Last Updated : 21 Mar, 2024

Summarize

Comments

Improve

What is Foreign Exchange Rate?

The foreign exchange rate is the rate at which one country’s currency can be exchanged for another country’s currency. Foreign exchange rates are influenced by various factors, including supply and demand dynamics in the foreign exchange market, economic indicators, geopolitical events, and central bank policies. For example, the Indian rupee (₹) in India, the Pound (£) in England, and the Dollar ($) in the United States of America. However, a country’s currency cannot be used in another country; For example, the Indian rupee (₹) can not be directly acceptable in the USA. In today’s world, countries have economic relations with each other. Thus, there is an increase in interdependence among the countries.

Geeky Takeaways:

- Central banks often intervene in the foreign exchange market to stabilize or influence their currency’s value, using tools like interest rates and foreign exchange reserves.

- Businesses and investors face exchange rate risk, as fluctuations can impact the value of international transactions, investments, and profits.

- Exchange rates serve as an essential indicator of global economic conditions, reflecting economic health, inflation rates, and political stability.

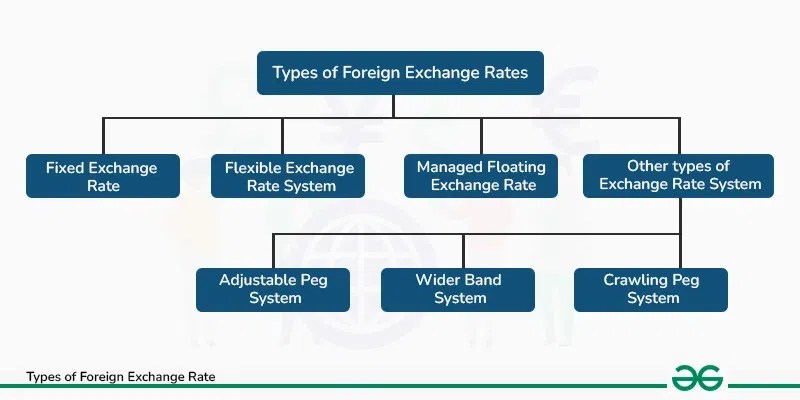

Types of Foreign Exchange Rates

There are three types of exchange rates; namely, Fixed Exchange Rate, Flexible Exchange Rate, and Managed Floating Exchange Rate.

1. Fixed Exchange Rate

Under this system, the exchange rate for the currency is fixed by the government. Thus, the government is responsible to maintain the stability of the exchange rate. Each country maintains the value of its currency in terms of some ‘external standard’ like gold, silver, another precious metal, or another country’s currency.

- The main purpose of a fixed exchange rate is to maintain stability in the country’s foreign trade and capital flows.

- The central bank or government purchases foreign exchange when the rate of foreign currency rises and sells foreign exchange when the rates fall to maintain the stability of the exchange rate.

- Thus, government has to maintain large reserves of foreign currencies to maintain a fixed exchange rate.

- When the value of one currency(domestic) is tied to another currency then this process is known as pegging and that’s why the fixed exchange rate system is also referred to as the Pegged Exchange Rate System.

- When the value of one currency(domestic) is fixed in terms of another currency or in terms of gold, then it is called the Parity Value of currency.

Methods of Fixed Exchange Rate in Earlier Times

1. Gold Standard System (1870-1914): As per this system, gold was taken as the common unit of parity between the currencies of different countries. Each country defines the value of its currency in terms of gold. Accordingly, the value of one currency is fixed in terms of another country’s currency after considering the gold value of each currency.

For example,

1£(UK Pound)= 5g of gold

1$(US Dollar)= 2g of gold

then the exchange rate would be £1(UK Pound) = $2.5(US Dollar)

2. Bretton Woods System (1944-1971): The gold standard system was replaced by the Bretton Woods System. This system was adopted to have clarity in the system. Even in the fixed exchange rate, it allowed some adjustments, thus it is called the ‘adjusted peg system of exchange rate’. Under this system:

- Countries were required to fix their currency against the US Dollar($).

- US Dollar was assigned gold value at a fixed price.

- The value of one currency say £(UK Pound) was pegged in terms of the US Dollar($), which ultimately implies the value of the currency in gold.

- Gold was considered an ultimate unit of parity.

- International Monetary Fund (IMF) worked as a central institution in controlling this system.

This is the system that was abandoned and replaced by the Flexible Exchange rate in 1977.

Devaluation and Revaluation

Devaluation includes a reduction in the value of the domestic currency in terms of foreign currencies by the government. Under a fixed exchange rate system, the government undertakes devaluation when the exchange rate is increased.

Revaluation refers to an increase in the value of the domestic currency by the government.

Difference between Devaluation and Depreciation

Merits of Fixed Exchange Rate System

- It ensures stability in the exchange rate. Thus it helps in promoting foreign trade.

- It helps the government to control inflation in the economy.

- It stops speculating in the foreign exchange market.

- It promotes capital movements in the domestic country as there are no uncertainties about foreign rates.

- It helps in preventing capital outflow.

Demerits of Fixed Exchange Rate System

- It requires high reserves of gold. Thus it hinders the movement of capital or foreign exchange.

- It may result in the undervaluation or overvaluation of the currency.

- It discourages the objective of having free markets.

- The country which follows this system may find it difficult to tackle depression or recession.

Fixed Exchange Rate has been discontinued because of many demerits of the system by all leading economies, including India.

2. Flexible Exchange Rate System

Under this system, the exchange rate for the currency is fixed by the forces of demand and supply of different currencies in the foreign exchange market. This system is also called the Floating Rate of Exchange or Free Exchange Rate. It is so because it is determined by the free play of supply and demand forces in the international money market.

- Under the Flexible Exchange Rate system, there is no intervention by the government.

- It is called flexible because the rate changes with the change in the market forces.

- The exchange rate is determined through interactions of banks, firms, and other institutions that want to buy and sell foreign exchange in the foreign exchange market.

- The rate at which the demand for foreign currency is equal to its supply is called the Par Rate of Exchange, Normal Rate, or Equilibrium Rate of Foreign Exchange.

Merits of Flexible Exchange Rate System

- With the flexible exchange rate system, there is no need for the government to hold any reserve.

- It eliminates the problem of overvaluation or undervaluation of the currency.

- It encourages venture capital in the form of foreign exchange.

- It also enhances efficiency in the allocation of resources.

Demerits of the Flexible Exchange Rate System

- It encourages speculation in the economy.

- There is no stability in the economy as the exchange rate keeps on fluctuating as per demand and supply.

- Under this, coordination of macro policies becomes inconvenient.

- There is uncertainty in the economy that discourages international trade.

3. Managed Floating Exchange Rate

It is the combination of the fixed rate system (the managed part) and the flexible rate system (the floating part), thus, it is also called a Hybrid System. It refers to the system in which the foreign exchange rate is determined by the market forces and the central bank stabilizes the exchange rate in case of appreciation or depreciation of the domestic currency.

- Under this system, the central bank acts as a bulk buyer or seller of foreign exchange to control the fluctuation in the exchange rate. The central bank sells foreign exchange when the exchange rate is high to bring it down and vice versa. It is done for the protection of the interest of importers and exporters.

- For this purpose, the central bank maintains the reserves of foreign exchange so that the exchange rate stays within a targeted value.

- If a country manipulates the exchange rate by not following the rules and regulations, then it is known as Dirty Floating.

- However, the central bank follows the necessary rules and regulations to influence the exchange rate.

Example of Managed Floating Exchange Rate

Suppose, India has adopted Managed Floating System and the Reserve Bank of India (Central Bank) wants to keep the exchange rate $1 = ₹60. And, let’s assume that the Reserve Bank of India is ready to tolerate small fluctuations, like from 59.75 to 60.25; i.e., .25.

If the value remains within the above limit, then there is no intervention. But if due to excess demand for the Indian rupee the value of the rupee starts declining below 59.75/$. Then, in that case, RBI will start increasing the supply of rupees by selling the rupees for dollars and acquiring holding of dollars.

Similarly, due to the excess supply of the Indian rupee, if the value of the rupee starts increasing above 60.25/$. Then, in that case, RBI will start increasing the demand for Indian rupees by exchanging the dollars for rupees and running down its holding of dollars.

Hence, in this way, the Reserve Bank of India maintains the exchange rate.

Other types of Exchange Rate System

Over the time period, because of the different changes in the global economic events, the exchange rate systems have evolved. Besides, fixed, flexible, and managed floating exchange rate systems, the other types of exchange rate systems are:

- Adjustable Peg System: An exchange rate system in which the member countries fix the exchange rate of their currencies against one specific currency is known as Adjustable Peg System. This exchange rate is fixed for a specific time period. However, in some cases, the currency can be repegged even before the expiry of the fixed time period. The currency can be repegged at a lower rate; i.e., devaluation, or at a higher rate; i.e., revaluation of currency.

- Wider Band System: An exchange rate system in which the member country can change its currency’s exchange value within a range of 10 percent is known as Wider Band System. It means that the country is allowed to devalue or revalue its currency by 10 percent to facilitate the adjustments in the Balance of Payments. For example, if a country has a surplus in its Balance of Payments account, then its currency can be appreciated by maximum of 10% from its parity value to correct the disequilibrium.

- Crawling Peg System: An exchange rate system which lies between the dirty floating system add adjustable peg system is known as Crawling Peg System. In this system, a country can specify the parity value for its currency and permits a small variation around that parity value. This rate of parity is adjusted regularly based on the requirements of the International Reserve of the country and changes in its money supply and prices.

Previous Article

Currency Depreciation and Currency Appreciation

Next Article

Demand and Supply for Foreign Exchange