Partner CenterFind a Broker

Like synchronized swimmers, some currency pairs move in tandem with each other.

And like magnets of the same poles that touch, other currency pairs move in opposite directions.

When you are simultaneously trading multiple currency pairs in your trading account, the most important thing is to make sure you’re aware of yourRISK EXPOSURE

When you are simultaneously trading multiple currency pairs in your trading account, the most important thing is to make sure you’re aware of yourRISK EXPOSURE

You might believe that you’re spreading or diversifying your risk by trading in different pairs, but you should know that many of them tend to move in the same direction.

By trading pairs that are highly correlated, you are just magnifying your risk!

Correlations between pairs can be strong or weak and last for weeks, months, or even years. But always know that they can change on a dime.

Staying up-to-date with currency correlations can help you make better decisions if you want to leverage, hedge, or diversify your trades.

A fewthings to remember…

Coefficients are calculated using daily closing prices.

Coefficients are calculated using daily closing prices.

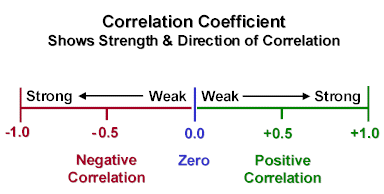

Positive coefficients indicate that the two currency pairs are positively correlated, meaning they generally move in the same direction.

Negative coefficients indicate that the two currency pairs are negatively correlated, meaning they generally move in opposite directions.

Correlation coefficient values near or at +1 or -1 mean the two currency pairs are highly related.

Correlations can be used to hedge, diversify, leverage up positions, and keep you out of positions that might cancel each other out.

Currency Pairs that Typically Move in the SAME Direction

- EUR/USD and GBP/USD

- EUR/USD and AUD/USD

- EUR/USD and NZD/USD

- USD/CHF and USD/JPY

- AUD/USD and NZD/USD

Currency Pairs That Typically Move in the OPPOSITE Direction

When analyzing the markets, you may come across two currency pairs that align with your trading strategy and have strong trading setups.

However, upon further examination, you notice that these pairs are highly correlated, meaning they tend to move in sync with each other.

In such cases, you should exercise caution and consider the implications of trading correlated pairs.

Trading Correlated Pairs: A Strategic Decision

When you find yourself wanting to trade two pairs that are highly correlated, it’s okay to take both setups. However, it’s important to:

- Assess the Risks: Understand the potential risks and consequences of trading correlated pairs.

- Apply Your Rules: Stick to your established rules and risk management protocols.

- Stay Vigilant: Continuously monitor your trades and adjust your strategy as needed.

By being aware of the risks and implementing a well-structured approach, you can effectively trade correlated currency pairs while minimizing potential drawbacks.

Quickly know what current correlations are for major currency pairs with our Currency Correlation tool.

Key Considerations for Using Currency Correlation in Trading

When utilizing currency correlation in trading, keep the following points in mind:

- Correlation is not causation: Correlated currencies may move together, but one currency’s movement doesn’t necessarily cause the other’s.

- Correlations change over time: Currency relationships can shift due to market conditions, economic events, and central bank actions.

- Correlation strength varies: Be aware of the strength and direction (positive or negative) of correlations.

- Use correlation in conjunction with other analysis: Combine correlation with technical and fundamental analysis for a comprehensive view.

- Monitor correlation during news events: Correlations can break down during high-impact news events or market volatility.

- Be aware of market conditions: Correlations can differ between trending and ranging markets.

- Keep an eye on interest rate differentials: Changes in interest rate differentials can impact currency correlations.

- Stay up-to-date with market analysis: Continuously update your understanding of currency correlations as market conditions evolve.

By remembering these considerations, you can effectively incorporate currency correlation into your trading strategy.