Getting a college degree and buying a home are two milestones many Americans aspire to. But as student debt skyrockets, theburden can often make homeownership tougher to achieve.

Almost one in four homebuyers this year had student loans, whichmade it harder for them to save for a down payment and delayed their purchase,according to the 2018 Homebuyer Profile report from the National Association of Realtors given to USA TODAY exclusively. Among buyers rejected for a mortgage from a lender, 40 percent had college debt, the NAR found.

Student debt will likely continue to vexhomebuyersas tuition climbs and more people go to college. That could ultimately crimp the housing market as these buyers put offpurchases to deal with their loans first.

“Student loan debt isnot just a hurdle now, it will likely be one going forward,” said Jessica Lautz, NAR’s managing director of survey research and communication. “It’s also an all-generation issue as we see parents taking on debt for their children or others going back to school.”

Learn more: Best personal loans

Down payment challenge

One of the first obstacles that indebted would-be buyers face is saving for a down payment, considered the hardest step by more than a quarter of buyers with loans, according to the NAR.

Two in five buyers, like Jodi Meyers, cut out luxury or nonessential items to save up for a home.

Rejected by the first mortgage lender she went to, Meyers, 44, consulted a second who said if she could cobble together $9,000, she could qualify for a loan. Meyers was paying off $55,000 in student loan debt after she went back to school during the recession to get a degree.

For three months last year, Meyers and her family – a husband and two adult children – squirreled away cash. She earmarked her tax refund for the purchase, deferred her $600-a-month student loan payment for two months and worked with her car lender to postpone a payment until after closing.

Then it was down to spending only on the necessities. “It was not easy,” she said. “Our food was just the basics – tuna fish and peanut butter and jelly sandwiches.”

At the end of it all was a $249,000, four-bedroom home in Lakeland, Florida, a 40-minute drive from where she and her family had rented,in the Disney-planned community ofCelebration, where houses started at $400,000.

“It’s not my dream home, but it got my foot in the door, and now I’m building equity,” she said of her new place.“But maybe one day we can sell and build our dream home in Celebration.”

More Money:401(k) account balances hit record high of $106,500; where do you stack up?

More Money:7-Eleven to launch scan-and-go at 14 Dallas stores

More Money:GM, Honda are betting Cruise founder Kyle Vogt can lead the autonomous car pack

Compromise needed

Like Meyers, many homebuyers with student debt had to forget their ideal home and settle on whatever they could afford. Seventy-six percent of buyers with student debt compromised on their home purchase this year, according to the NAR data, versus 63 percent with no loans.

Jackie Kuykendall and her husband, Pepe Santana, both psychologists saddled with $440,000 in loans, could only prequalify for a mortgage if Santana, 44, dropped from the application andKuykendall'smother co-signed the loan. Even after that, they were limited to condos and townhouses in a Denver suburb – instead of a house in the city limits – because prices were too high for their $330,000 budget.

“Because of our price point and the Denver market’sshort supply, we didn’t look for very long there,” said Kuykendall, 39. “There were some weekends no property met our criteria.”

As they encountered one bidding war after another, they looked for cheaper homes so they could compete with other offers. They landed a three-bedroom townhouse in Westminster, Colorado, after beating out 20 other buyers. They bid $290,000, or about $30,000 more than the listing price.

“We really like being homeowners and having a place to plan for the future,”Kuykendallsaid.

But she isn't done looking.

“Even though we adore this condo, we would like a house, so my daughter can have a yard.”

Debt-to-income a killer

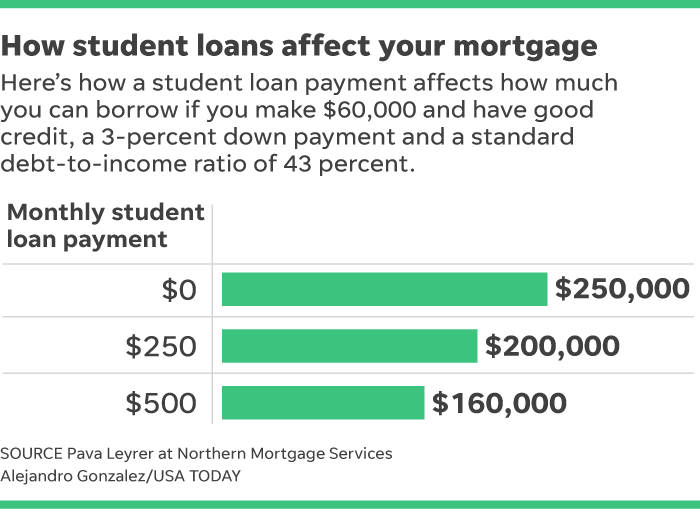

One of the biggest obstacles facing buyers with student debt is a strict requirement from lenders offering government-backed mortgages: It'scalled debt-to-income, or DTI.

The DTI ratio shows what percentage of your monthly income goes to paying your debt payments. Simply divide your gross income by your total minimum payments on your debts, including your hypothetical mortgage payment, to calculate the ratio. The higher the percentage, the lower mortgage you qualify for.

For Cristina Colacci, an interior designer paying off $60,000 in education loans, her monthlypayment killed her DTI.It started at $600 per monthbut was down to $200 per month by the time she applied for a mortgage.She and her husband, an architectural drafter, qualified for $100,000 less than a similar couple without student loans.

“Based on our income, we should have been able to afford $450,000, but because of my monthly payment, that dropped us to $340,000,” saidColacci,, 40. “That makes a big difference in New Jersey. That’s the bottom rung of houses.”

It tookColacci and her husband three years to find a three-bedroom home that was move-in ready enough and still within their price range. That was after losing bidding wars on six other homes.Colaccieven became a licensed real estate agent because she was so frustrated by their search.

“We either needed to move away or find a way to make more income,” she said. “The only reason I was able to afford this house is because, as an agent, I could waive my commission.”