The inside bar can be an extremely effective Forex price action strategy.

However, the effectiveness of the inside bar strategy is largely based on the price action surrounding it. In other words, an inside bar alone does not constitute a valid trade setup.

Far from it.

We need additional clues to tell us that the potential reward is worth the associated risk. Thatisn't always easy because there are multiple factors that play a role.

But that's okaybecause by the time you finish this lesson you will have a firm grasp of not only how to identify favorable inside bar setups, but how to trade them for a profit.

Let's kick things off with a video I put together for you.

So what kind of factors play a role?

Let’s take a look!

What is an Inside Bar, Anyway?

Said differently, the previous candle completely “engulfs” the inside bar. Keep in mind that we’re talking about the entire range of the candle (high to low) so we aren’t concerned with the open or close of either bar.

As shown in the image to the right, the engulfing candle is more appropriately referred to as the “mother bar”.

Note once again that we’re only focused on the mother bar’s high and low, which forms the range of that period.

Time Frame Matters

The first thing we need to know about the price action inside bar strategyis that it works best on the higher time frames.

For those familiar with the way I trade, you know that I do about 90% of my trading on the daily time frame, with the other 10% spent on the 4-hour charts.

The reason the inside bar works best on the daily chart is because you don’t get all the ‘noise’ that you do on the lower time frames. The daily chart acts as a natural filter and therefore produces cleaner price action patterns that can help put the odds in your favorif you know what to look for. 😉

The inside bar also works best on the daily time frame (or anything higher) because it simply doesn’t occur as often, so the worthwhile trade setups become more obvious.

If you look at a one hour chart, you can probably find multiple inside bars in a single day, whereas you might find just one or two inside bars on the daily chart for the same currency pair.

Context is Key

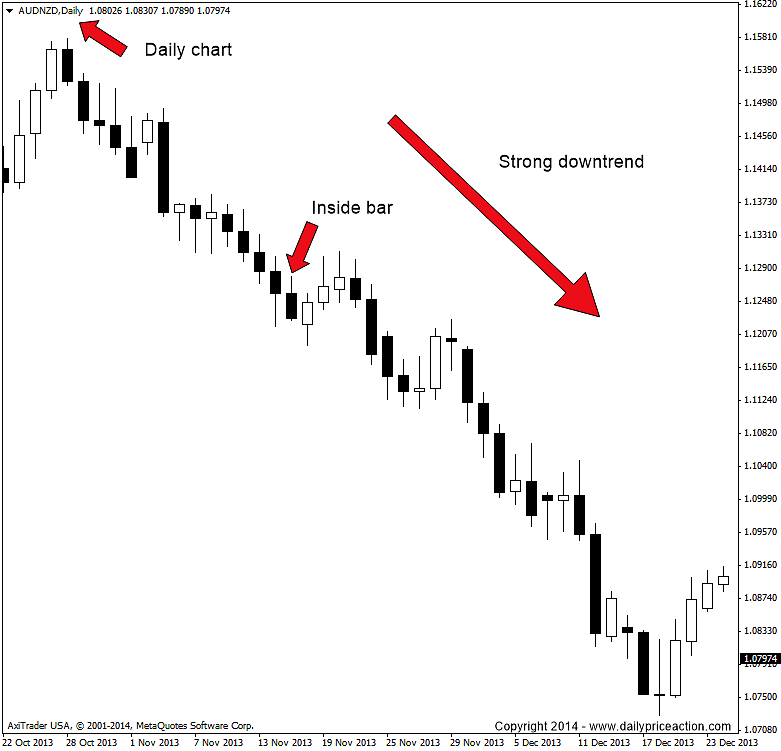

So now that we’re all on the daily time frame looking for inside bars, the third thing you need to know is that it must occur within a strong trend.

An inside bar in consolidation won’t give us clear ‘directional bias’, which we must have to constitute an effective inside bar setup.

Here’s a short video to help explain this point.

http://dailypriceaction.wistia.com/medias/m414gh1qpe?embedType=async&videoFoam=true&videoWidth=640

To illustrate the significance of this requirement, I’ve included two annotated charts below. Notice how the price action inside bar that occurred within a strong trend was very obvious and would have given us a nice gain, while the inside bars that occurred within consolidation were not as obvious and would’ve been difficult to trade with any degree of confidence.

The chart below shows multiple inside bars in a consolidating market. Notice how it’s very “choppy”, providing no clear directional bias.

So let’s recap. We’re looking for inside bars that occur on the daily time frame in a strong trending market. The example above was an uptrend but they are just as effective (if not more) in a strong downtrend.

So what else do we need to look for?

Relative Size Matters

Why does size matter? Well, size itself doesn’t matter so much, butthe size of the inside bar relative to the mother bar is critically important. Let me explain… We all know inside bars come in all shapes and sizes, but when it comes to a validprice actioninside bar trade setup, the inside bar must be a size that’s conducive to trade relative to the mother bar. That might sound confusing for now, but it will soon make sense, I promise!

In order to properly explain relative size, we need to discuss how to enter an inside bar trade and where to place our stop loss.

How to Enter an Inside Bar Setup

The best place to enter an inside bar is on a break of the mother bar high or low in the direction of the trend. Here’s how I would’ve entered the inside bar trade we looked at earlier.

So now we know where to enter the inside bar trade, but to really understand why relative size is important we need to understand where to place our stop loss order.

Inside Bar Stop Loss Placement

We have two options when placing our stop loss order. The first option is to place our stop loss just below the mother bar low. This is considered the safer approach, however the downside is that you won’t get the best risk to reward ratio possible by placing your stop loss below the mother bar.

The second option is to place the stop loss below the inside bar low. I’ve found over the years that this placement not only gives us the best risk to reward, but it’s also a relatively safe place to ‘hide’ your stop loss order.

Let’s take a look at both options.

You may already know where I’m going with this, but before we go any further let’s sum up what we have so far.

- We’re looking for inside bars on the daily time frame

- The inside bar must occur in a strong trend (directional bias)

- We enter the inside bar trade on a break of the mother bar high or low

- We place our stop loss just below the inside bar high or low

Still with me? Ok, good! I’m going to finish this lesson by discussing why the relative size of the inside bar matters and what it has to do with the entry and stop loss placement we just discussed. I’ll give you a hint…it has to do with profit targets andrisk to reward ratios.

I’m not going to get too deep into risk to reward, aka R ratio or R multiple. Just know that we should always aim for, at minimum, a 1:2 risk to reward. So if our stop loss needs to be 50 pips away, our profit target must give us at least 100 pips. Ahh…now you’re seeing why the size of the inside bar relative to the mother bar is so important. 😉

The EURJPY example above works for us, because there was no immediate resistance above. The stop loss would need to be 100 pips away from our entry, and the trade would have easily given us 200 pips or more.

Let’s look at our last example where the relative size of the price action inside bar would negate the trade setup based on our profit target. On the surface this looks like a valid inside bar trade setup. We have an inside bar on the daily chart in a strong downtrend…everything looks good.

Now let’s take a look at the same setup, only this time we will look back a few weeks to see why this setup didn’t work.

As you can see, previous support and resistance levels play an important role when determining whether an inside bar is worth trading. So, what this means that relative size of the inside bar to the mother bar is important, but support and resistance levels are equally important. They all go hand in hand if you ask me.

I see many traders making the mistake of taking inside bar trades without clearly defining their support and resistance levels. This is just asking for trouble. It’s like not looking in your rear view mirrors before changing lanes on the highway. You need to know what previous price action has done in order to put the odds in your favor. This is true for any type of price action setup, not just inside bars.

I hope this lesson has provided you with some helpful tips that you can implement in your trading plan. I get into much more detail in my Forex trading courseon how to trade price action inside bars as well as several other setups I use when trading my own account.

If you liked this post, please share it with your friends using the social sharing buttons below. Also be sure to sign up to our newsletter belowso that we can notify you as soon as new content is posted.

Your Turn

How do you trade inside bars? If you don’t currently trade them, why not?Post your comments or questions below.