Making six figures a year is a lot of money. However, depending on where you live, making six figures may still not make you feel rich! Due to higher cost of living and inflation, making six figures is no longer a guarantee for high living.

One of the great things about America is freedom. Tired of feeling like death living in Chicago, New York City, or Boston during the winter? Why hello San Diego, Miami, orHonolulu!

Not feeling there are enough job opportunities for advancement in Detroit? Then come on down to San Francisco! Thanks to the growth in technology and artificial intelligence, well-paying job opportunities and investment opportunities are abundant.

Tired of eating healthy food in San Francisco that costs an arm and a leg despite having a six figure salary? No citycan beat the wonderful soul food of New Orleans.

Geoarbitrage is a term where one can earn and save money in one place and move to a cheaper location to maximize their money. If you happen to own an internet business, then your ability to geo-arbitrage is greatest.

I've often thought about just relocating to Thailand for several months at a time given friends say they live extremely well off $2,000 a month for two. Given one of my goals is to take 100 hours of intensiveMandarin lessons, I may very well be writing to you from some lower cost country in the future.

In Search For More Riches Online

70% of the audience comes to Financial Samuraithrough a search engine like Google. They have a financial problem they are trying to solve. This is huge because it takes initiative to come to grips with one's finances.

But what I've noticed over time is that besides the middle class gettingpissed off about the widening wealthgap, upper-income earners making six figures or more are also feeling some angst as well. During a bull market, the rich get richer given the rich make and have the most.

Over 50% of singles readers and 74% of household readers make over $100,000 a year based on my Financial Samurai income poll (14,000+ so far down below). As a result, I'd like to delve into analyzing how a “typical” $200,000 a year household spends their six figure income.

A six figure salary can range from $100,000 to $999,999. So I figure I'd start on the low end for two people. $200,000 is a comfortable household income, but I don't think it can qualify as rich. With inflation running at 40-year highs, households need to earn more to run in place.

Making $200,000 A YearAnd Still Feeling Average

Below is a chart that shows how making six figures a year is pretty average in a city with a child. Expenses really add up. And these include investment expenses as well.

This lovely family of three living in San Francisco, with two working parents making $100,000 each (hooray for income equality!) are left with roughly $5,700 a year in disposable income after expenses and 401k contribution. Given their total cost is $121,700 after tax a year, that's roughly $10,000 a month they're spending.

Here in San Francisco, if you make $117,000 for a family of three, you can apply for low-income housing. When looking at six figure incomes, it's important to always compare living costs.

I can hear the detractors now. So let me preempt your complaints by addressing them up front. Just know there are families making $500,00 a year and scraping by! Let's review some of this family's expenses.

Mortgage: $36,000

This six figure income family took out a $640,000 mortgage at 3.75% after putting down $160,000 for a two bedroom, two bathroom single family homein the outer regions of San Francisco. Their payment is $3,000 a month, or $36,000 a year. 70% of their $36,000 mortgage is interest. Take 70% X $36,000 = $25,200 a year in interest they are paying which is deductible from their $200,000 gross salary.

The family now has $18,000 (401k) + $25,200 (interest) in deductions. To make math easier, let's just take the $25,200 in interest and multiply it by their federal marginal tax rate of 30% (they straddle the 28% and 33% federal income tax bracket) to get $7,560. In other words, when they file their taxes they should get roughly $7,560 back on top of the $5,700 left over they are saving.

This family now has roughly $13,260 in disposable income after maxing out their 401k after they file their taxes. For every year they work, they can save a little over one month in living expenses before they feel great strain. Their effective tax rateis probably closer to 27% than the stated 30% in the chart.

Check out Credible to get a personalized, no-cost, no-obligation rate. Competing lenders compete for your business so you can get the best rate possible. I was able to get a new purchase 7/1 ARM mortgage for only 2.125% with no fees! Rates are finally coming back down.

Childcare: $24,000

Yikes! Childcare is expensive.The average cost of center-based daycare in the United States is $11,666 per year ($972 a month), but prices range from $3,582 to $18,773 a year ($300 to $1,564 monthly), according to the National Association of Child Care Resource & Referral Agencies (NACCRRA).

OK, so my $24,000 childcare estimate is high. But it is high because I also asked five friends in San Francisco who have kids in childcare and that's what they say they pay. Remember, averages don't properly estimate the true costs in many departments. Besides, I haven't even included the cost of private school tuition as an option!

If you get a night doula for a newborn, expect to pay $5,000 – $10,000 a month! It's costly, but the mother will love it. Alternatively, you may go the less expensive route and get an au pair.

With an au pair, you provide the person housing and food versus a nanny who just comes to your house during the day.

Two Vacations A Year: $8,000

Damn, Gina! What kind of vacations cost $4,000 each for a family of three? How about a good old fashion staycation, or camping in the woods for $200 bucks instead?

I'm a big proponent of staycations and road trips, especially now that gas is so cheap, but this is a hard working couple who only have four weeks of vacation a year. Their time is so valuable that they want to live it up and yolo when they can.

Let's see, three roundtrip ticketsto Maui from San Franciscocosts around $750 each during peak season (goes up to $1,200 actually). That's $2,250 on airplane tickets right there. Lodging costs $300 a night after tax for something very average. That's $2,100 for a week's hotel stay for a total of $4,350.

Meanwhile, the family hasn't even eaten or paid for any type of fun activities yet! The total cost of a two week vacation to Hawaii can easily go over$6,000.

A More Frugal Vacation

Let's say the family decides to be a little frugal for their remaining two weeks of vacation by renting out the one bedroom portion of my two bedroom condoin Lake Tahoe this summer. The price is an internet low $195 a night (vs. $250+) + the $25 Resort fee, cleaning fee, and taxes.

The total price comes out to $1,708 for check in July 9, check out 7/16 for seven nights. Now let's add on $50 for gas round trip. Add on $600 for food and fun and we're talking only $2,358 for a week in one of the most beautiful places to go during the summer.

Car Payments: $6,000

What a waste! But a $500 a month car payment (after tax and fees) is so common for many Americans nowadays given the median price of a new car is $32,000. I was considering leasing a $41,000 Jeep Grand Cherokee Limited for ~$500 a month, but decided to go for my dream car, a $19,025 pre-tax 2015 Honda Fit instead.

A $500 a month car payment (based off a $5,000 downpayment, another big waste of money) allows one to drive a BMW 3 series, Mercedes C-class, Lexus IS250, Audi A4, and a Jeep Grand Cherokee.

These cars are definitely a notch more luxurious than your Honda Accords and Toyota Camrys ($21,000 – $26,000) and so forth. But a $40,000 – $50,000 BMW 3 series is pretty common for a family making $200,000 a year, even though

I recommend a family should spend no more than $20,000 for a car. Just read the 500+ comments in my post on the 1/10th Rule For Car Buying Everyone Must Followand see for yourself.

$4,800 a year on gas seems high now that gas prices have plummeted. So let's say the $4,800 includes all transportation costs, including bus fare, taxi rides, Ubers, and gas.

Related reading: How To Make Over $100 An Hour Driving For Uber

Student Loans: $0

A lot of readers who make a $200,000 six figure income level have pointed out in the comments that this couple is lucky because they don't have any student loans. They are right! They paid for their education along with the help from their parents.

If you're looking to refinance your student loans, I suggest checking out Credible as well. They are the leading student loan refinance marketplace where you can compare real quotes to get the best rate possible with no obligations. It takes just two minutes to get an offer.

Just double check on the latest government student loan rules.

Taxes: 30% effective

A 30% effective tax rate may be several percentage points higher than reality. The six figure income married couple is at a 24% marginal federal tax rate as of 2018. If they were to only pay federal taxes, the effective tax rate is closer to ~22%. But they live in California, where they face a state income tax rate of 9.3%!

But, oh yeah, they also have to pay FICA tax on wages up to $147,000for 2022. That's another 6.2% for Social Security + 1.45% for Medicare = 7.65%. It's easy to see how the total effective tax rate is about 30%.

Thank goodness they have $25,200 a year in mortgage interest they can use to lower their taxable income by that same amount.

Property Taxes: $8,000

The $200,000 six figure income family lives in San Francisco and pay a property tax rate of 1.24% on the assessed value of their property. They bought property for $650,000 a year ago, and the city has assessed the property at $667,000.

Due to Proposition 13, property values can only be assessed by an index that rises no greater than 2% a year, even if the property might increase in value by 20%. If they were to sell their property now, they could probably get $700,000 or more since San Francisco prices have continued to go up.

If you want to invest in real estate more surgically, I recommend checking out Fundrise, the best real estate crowdfunding platform today. They are a great way to diversify your real estate holdings, especially into the heartland of America where valuations are much cheaper and net rental yields are much higher.

Another large platform is CrowdStreet, which specializes in individual opportunities in 18-hour cities. 18-hour cities are like Memphis and Charleston where valuations are lower and growth rates are faster. However, before investing in each deal, make sure to do extensive due diligence on each sponsor. Understanding each sponsor's track record and experience is vital.

I've personally invested $810,000 in real estate crowdfunding to simplify life and earn a higher income in early retirement. It's great to earn income 100% passively!

Healthcare Expenses: $$$

Employers generally subsidize your healthcare premiums through a group health insurance plan. The cost can range from $0/month – $800/month for a family. It all depends on how generous your employer's benefits are.

College Savings: Whatever is left over

Another missing item from the spreadsheet is college savings. Like most families with young kids, they aren't putting aside a specific amount of money yet because they've still got 10-15 years to go.

They've decided to just focus on saving for their retirement first in their 401k and after-tax brokerage account. Parents should also consider contributing up to $15,000 a year in their child's 529 College Savings plan as soon as they are born.

When the time comes for their kids to go to hopefully public school, they'll draw from their savings and brokerage accounts to pay as they go. Parents should also consider using a 529 plan for generational wealth transfer purposes.

You Can Make Six Figures And Not Feel Rich In These Cities

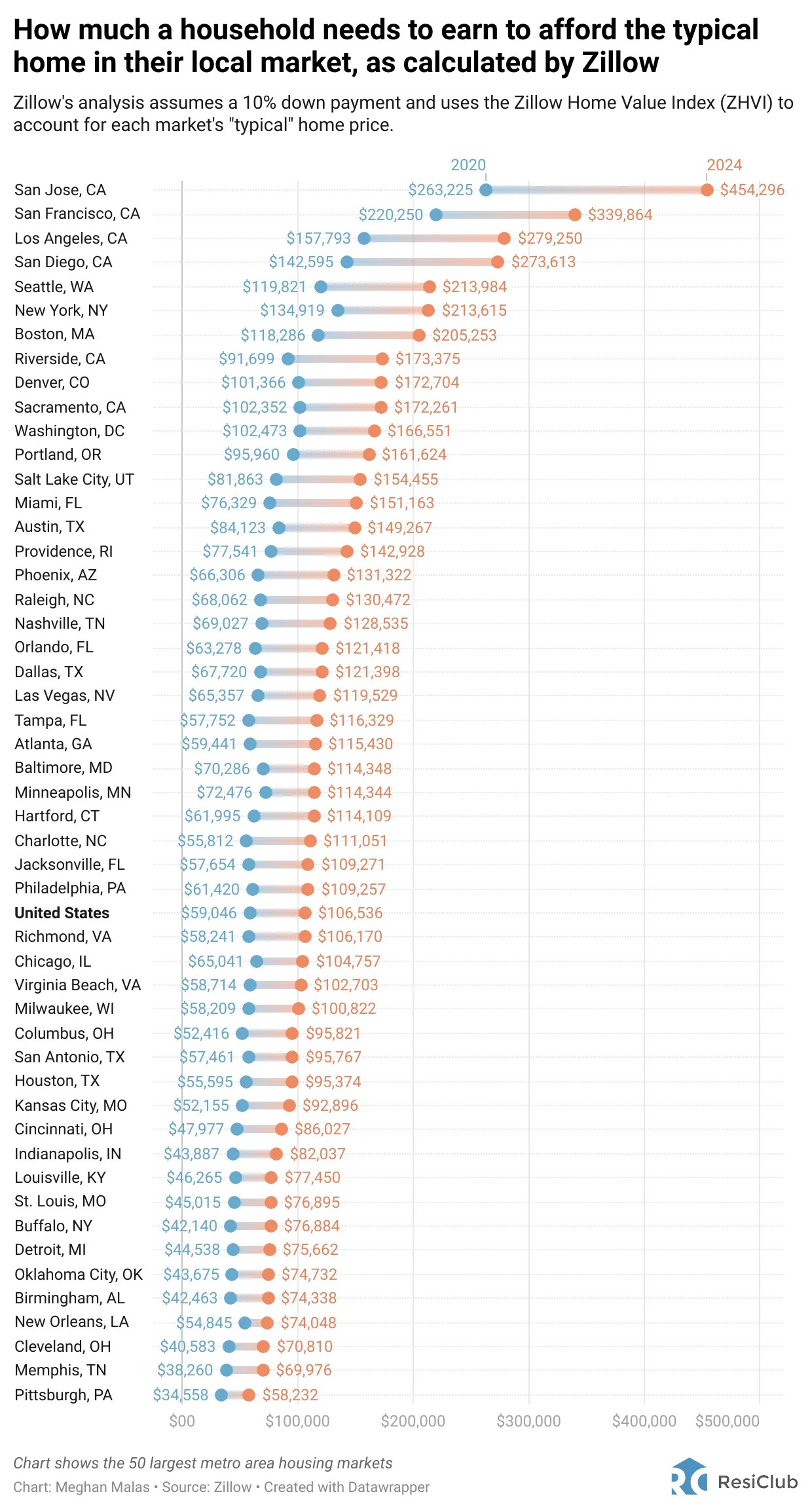

For 2024, Zillow came out with an insightful study on income required to afford a typical home in the largest 50 cities. For the entire United States, $106,536 is required to buy the median priced home in America, which is currently around $420,000.

Based on the analysis, if you live in San Jose, San Francisco, LA, San Diego, Seattle, New York, Boston, Riverside, Denver, Sacramento, Washington, DC, Portland, Salt Lake City, Miami all the way down to Milwaukee, you will NOT feel rich making six figures in these cities.

The reason is because earning six figures is REQUIRED to simply own a typical home in the city. And feeling rich means feeling like you've got more than others.

Don't Let Money Rule Your Life

I read some study that in order for youto feel rich, youhave to make 3X as much as youcurrently make, no matter what youmake. So if you're making $50,000 a year, $150,000 a year in income will make you feel like making it rain at the clubs.

But if you're making $150,000 a year in income, you won't feel rich until you make $450,000 a year. In other words, human beings don't ever seem to be satisfied with what they have.

What we like to do is project our emotions onto other people. So for all those people making less than $52,000 a year, it's easy to say any household making $200,000 a year should feel rich and should shut the hell up about paying a progressive tax rate.

Making as much money through non-wage income (W2) is what it's all about.

The family in my example is going to live a nice and comfortable life, no doubt. After 20 years of work, they'll likely have saved over $500,000 in their 401k, and perhaps another $100,000 in after tax investments and savings, even if their $200,000 income stays static.

Nobody is going to cry for them. I just don't think this six figure income family will ever feel rich, just comfortable since they have to keep on working and paying an ever increasing tax rate.

Loading ...

Loading ...

Loading ...

Loading ...

Diversify Your Investments Into Real Estate

One of my favorite ways to get rich is through real estate. The combination of rising rents and rising capital values is a very powerful wealth-builder. Mainly thanks to rental income, I was able to leave my day job in 2012 at age 34.

In 2016, I starteddiversifying into heartland real estateto take advantage of lower valuations and higher cap rates. I did so by investing $954,000 withreal estate crowdfunding platforms.

With interest rates down, the value of cash flow is up. Further, the pandemic has made working from home more common.

Take a look at the two best private real estate platforms

Fundrise: A way for all investors to diversify into real estate through private funds with just $10. Fundrise has been around since 2012 and manages over $3.5 billion for 500,000+ investors.

The real estate platform invests primarily in residential and industrial properties in the Sunbelt, where valuations are cheaper and yields are higher. The spreading out of America is a long-term demographic trend. For most people, investing in a diversified fund is the way to go.

CrowdStreet: A way for accredited investors to invest in individual real estate opportunities mostly in 18-hour cities. 18-hour cities are secondary cities with lower valuations and higher rental yields. These cities also have higher growth potential due to job growth and demographic trends.

If you are a real estate enthusiast with more time, you can build your own diversified real estate portfolio with CrowdStreet.However, before investing in each deal, make sure to do extensive due diligence on each sponsor. Understanding each sponsor's track record and experience is vital.

Fundrise and Crowdstreet are long-time sponsors of Financial Samurai and Financial Samurai is an investor in Fundrise funds.

Manage Your Finances In One Place

Get a handle on your finances bysigning up withEmpower. It is afree online platform which aggregates all your financial accounts in one place so you can better optimize your money. Even at a high income, money escapes like water from a leaky bucket if you don't carefully track where it all goes.

Before Empower, I had to log into eight different systems to track 30+ difference accounts. Now, I can just log in to see how all my accounts are doing, including my net worth.I can also see how much I’m spending and saving every month through their cash flow tool.

The best feature is their Portfolio Fee Analyzer, which runs your investment portfolio(s) through its software in a click of a button to see what you are paying. I found out I was paying $1,700 a year in portfolio fees I had no idea I was hemorrhaging!

There is no better free financial tool online that will help you build your wealth for financial freedom.