In this article we’ll cover 6 of the top ways to estimate a private company’s financials (including revenue).

1. Company Databases

Here are some of the best company databases that specialize in collecting and tracking private company data.

PitchBook: A popular site for capital markets data, including private company fundamentals. The site also shows users how financial metrics are calculated using charts and tables. Even if PitchBook doesn’t provide precise revenue numbers, it will offer insight into VC funding rounds, which should give you an idea of a company’s growth potential.

Privco: A powerful search engine for private company data, including the latest revenues, EBITDA, etc. Privco boasts a database of roughly 800,000 private U.S. companies.

D&B Hoovers: This platform is designed as a sales accelerator, providing access to corporate contact information as well as the financials on tens of millions of privately held companies.

2. Customer Reach

Once you have the following two metrics – total customer count and pricing – estimating revenue is simple math:

Number of customers * price of product or service over a specific timeframe = revenue

First, you’ll need to figure out the number of customers that the company serves in a given period (even if it’s a ballpark figure).

Many private companies will disclose customer numbers in:

- Announcements: When they are trumpeting a milestone or product launch

- Press releases: Official company announcements that are often picked up by the media

- Social media posts: X, Facebook, TikTok, Instagram, etc. These sites are increasingly being used by startup founders to share revenue, customer and growth metrics.

- Company’s website: Specifically, about pages will sometimes list a company’s entire team.

- Job postings: Employers will sometimes reveal company numbers in an effort to attract top talent.

Next you’ll need to review the company’s pricing model.

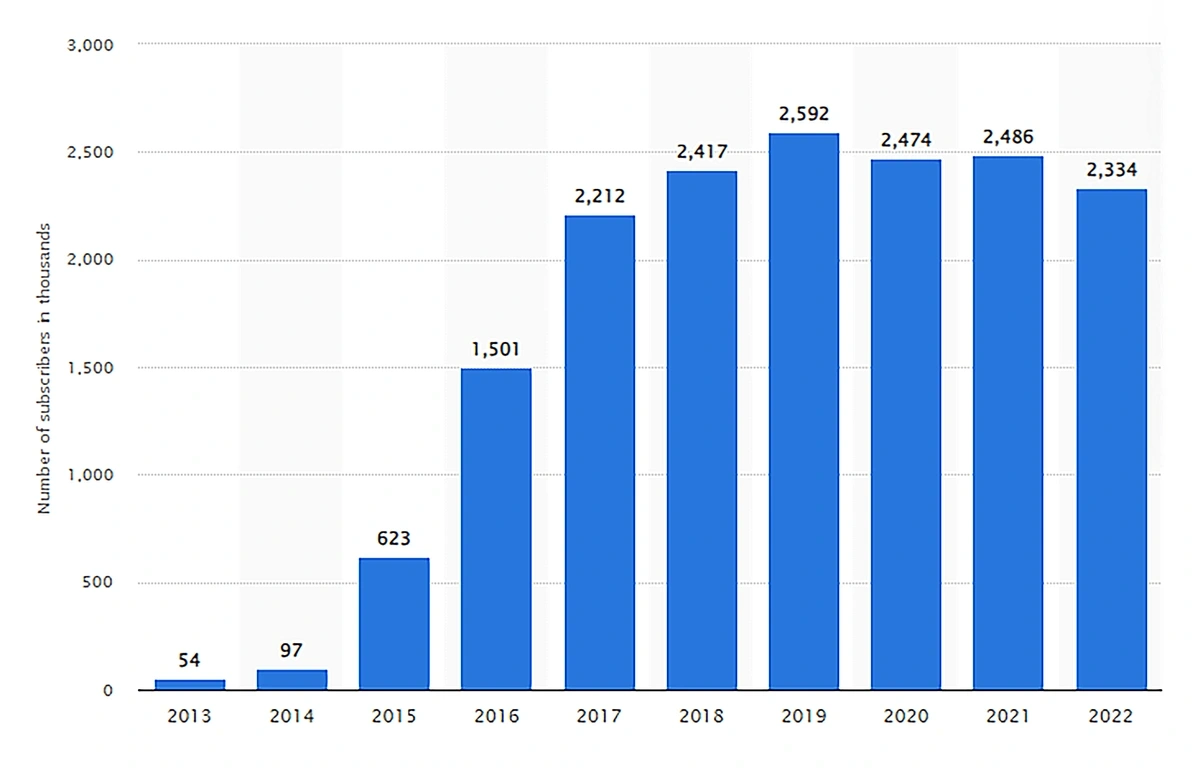

Statista can be a great source for customer data.

For example, the below chart reflects Sling TV’s U.S. subscriber numbers, in thousands, from 2013-2022, which can be paired with Sling’s pricing model to estimate their revenue.

In this case, private streaming company Sling has roughly 2 million subscribers.

Taking this example further, Sling’s pricing model is two-tiered – Orange and Blue – both of which start at $40. For simplicity’s sake, let’s go with:

2 million subscribers * $40 monthly subscription = $80 million in monthly revenue for Sling TV

Again, this is just an estimate.

But it’s likely in the right ballpark range as the two sources (customer data and pricing data) are from the company itself.

3. Revenue Per Employee Model

If your company’s budget doesn’t allow for paid services, like PitchBook, Hoovers, or D&B, you can use sites like Owler, Crunchbase, or LinkedIn, similar platforms to see a company’s headcount.

Here’s the revenue per employee, or revenue per headcount, equation:

- Total Revenue / the number of full-time employees = Revenue Per Employee.

Take the software-as-a-service (SaaS) industry, where we don’t have an average annual revenue number but know that the median revenue per employee is $112,500. Let’s say our private company has 15 employees. Here’s the formula:

$112,500 x 15 = approximately $1.7 million in annual revenue

Let’s try another example.

MegaMeeting is a video conferencing platform like Zoom. However, with over $4 billion in annual revenue, Zoom is in a class all itself. Rather than comparing Zoom’s financials to MegaMeeting’s, let’s turn to the revenue per employee model.

According to LinkedIn, MegaMeeting has between 11-50 employees. Company database platform Growjo pegs MegaMeeting’s number of employees at 16.

Growjo also provides us with MegaMeeting’s estimated revenue per employee of $92,438. Therefore, we learn that…

$92,438 x 16 = $1.5 million in MegaMeeting’s annual revenue (approximately)

4. Financial Sites

If the company you are researching is big enough, finding revenue could be simpler than you think.

For example, financial publishers like Forbes and Bloomberg are known to publish financial data about privately held businesses that are on their radar.

There are even industry-specific startup lists (like Latka) that have revenue data on 30k+ SaaS companies.

Moody’s is another gem where you can find private company revenue if you are willing to do some digging. Moody’s is in the business of assigning ratings on corporate debt, including privately held entities. When they publish ratings changes, they might reference a company’s sales.

For example, in 2021, Moody’s assigned a rating to fresh debt taken on by PetSmart, disclosing in the announcement that:Petsmart’s revenue = approximately $7.5 billion.

5. VC Funding

To use VC funding as a proxy for revenue, you'll have to read between the lines based on the type of funding the startup just raised.

This is because the type of funding round that a venture capitalist participates in corresponds with a startup’s revenue performance. These are only jumping off points from which you can make some assumptions:

- Pre-Seed - the company has yet to generate any revenue

- Series A - Pre-revenue

- Series B - Generating revenue

- Series C - Business is considered successful

- Series D - The company is generating substantial revenue

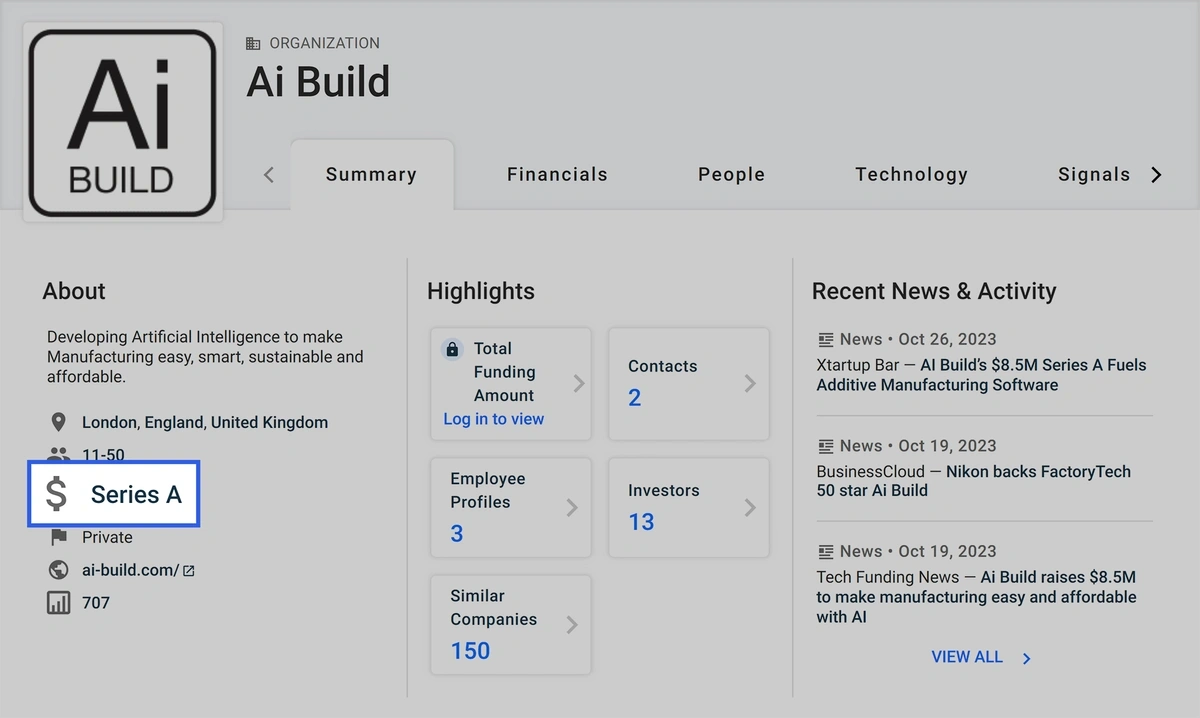

From Crunchbase, we learn that a startup dubbed Ai Build has completed a Series A funding round.

The startup has also completed a seed round. Based on that data, it’s likely that Ai build remains in the pre-revenue stage.

6. Comparison Data

Let’s compare privately held Chick-fil-A with publicly traded Chipotle. Both restaurants have approximately 3,000 locations and employee counts in the ballpark of 100,000.

- Chipotle’s revenue was $9.2 billion in the 12-month period ended on June 30, 2023.

- Chick fil A’s revenue was estimated to be $11.3 billion in the latest 12-month period, according to career site Zippia.

Therefore, we can see that benchmarking our private company’s revenue based on our public company’s revenue is not too far fetched.

The use of comparable data is widespread in the real estate industry, where agents rely on the performance of relevant deals to assess the potential value of a property. Using private comparables is a similar concept.

It’s possible that privately held and publicly traded companies operating in the same industry share similar financials. This is why private comparables are so important - because they can be close to actual performance.

The key is to compare two companies with similar features in terms of the industry, size, growth potential, risks, etc. Generally speaking, private companies are valued at a discount relative to their publicly traded peers for a variety of reasons.

As a general rule of thumb, a privately held company will be valued between 30% and 40% belowits publicly traded peer.

Conclusion

Finding a private company’s revenue is not an exact science, but it is possible to come up with a pretty good ballpark figure. You may have to tweak your approach based on the amount of information that is available on each company, but with so many options, you should be able to find one that works for you.