research • April 26, 2021

In this report, Will Nuelle of Galaxy Digital’s Principal Investing team identifies the emerging risk-free rate in DeFi and discusses factors contributing to its variance, including the basis trade.

The "Risk-Free" Rate

Introduction. In the market, risk-free returns are a gravitational body around which all other opportunities orbit. In decentralized finance, lending rates for stablecoins on Aave and Compound and attained yield from Yearn will have the same power.

Annualized yields on 10yr and 30yr US Treasuries have historically been the risk-free rate in US finance: the baseline return against which all other positions are evaluated. Either a disproportionately high (1980s) or low (today) interest rate can have considerable consequences for the broader economy. Take ’80-’82 as an example: a 11% - 14% rate on the 30yr US Treasury drew capital into the high-yielding sovereign debt, causing capital investment in private US businesses and risk assets to slow, ultimately leading to a recession. Alternatively, today low interest rates force investors to hunt for yield further out on the risk spectrum. As the risk-free rate goes, all else follows.

In this piece, we discuss three points:

A risk-free rate is an important feature of any financial system against which all other yields can be benchmarked, both in traditional finance and decentralized finance.

Decentralized finance now includes primitives like Compound, Aave, and Yearn that have allowed an informal risk-free rate to emerge. Other venues will emerge too, like a senior tranche product for a stablecoin-ETH pair in a decentralized exchange liquidity pool.

There are many structural factors that drive changes in DeFi’s risk-free rate today—short-term factors like yield farming, but also long-term factors like the “basis” trade. We evaluate the relationship between on-chain deposit APYs and the “basis” trade, in particular.

Risk-Free rate in DeFi. In DeFi, we’re seeing the emergence of a fragmented “risk-free” rate market comprised of secured stablecoin loans on protocols like Compound, Aave, and Yearn. Dollar-denominated DeFi-based investors must ask themselves: “what investments are going to beat the baseline return earned by depositing Dai or USDC into Compound/Aave?” Investments in crypto will continue to be measured against this baseline.

The risk-free rate offered can be a selling point to those outside of crypto: if a normal consumer bank offers 0.50% on dollar-denominated deposits, getting 4.0% is far superior and should encourage enterprising consumers to switch. As DeFi scales to a larger audience, the dynamics of the risk-free rate will influence the course of DeFi adoption.

Over the next 3 years, mainstream players will enter DeFi for a variety of reasons. Some will enter on the capital supply side, such as consumers seeking high-yield savings accounts. Others will enter on the demand side—real-world borrowers tapping DeFi liquidity because of competitive cost of capital. The “risk-free rate” will be crucial in this story:

High risk-free rate. If the risk-free rate is too high, borrowers (capital demand) will have to pay sky-high interest rates, making DeFi liquidity uncompetitive against broader interest rate markets. (This creates a walled arbitrage opportunity for participants who can access dollar borrows from traditional financial institutions.)

Low risk-free rate. If the risk-free rate is too low, incoming depositors (capital supply) to high-yield savings accounts like Dharma, Growth, and Yearn won’t be sufficiently incentivized to enter the ecosystem versus the technical complexity and assessed risk.

The good news. DeFi has an exceptional quality in its favor: the chance to replicate the low cost-of-capital of banks. Banks make money because they have cheap deposits: consumers are willing to take 0.10% for security and banks can lend it out at higher rates, historically at >3% net interest margin. But in crypto, protocols like Maker can mint dollar-equivalents at 0% cost (if they can manage the risk correctly). Moreover, the asymmetric demand for dollars in crypto can draw deposits seeking higher yields than what a bank offers to depositors.

The concept of “risk-free” in DeFi. Risk-free takes on a different dimension in DeFi because of the risks always implied, despite being as close to riskless as DeFi can be. While Gauntlet has done good work to show that Compound and Aave are economically robust, existential smart contract risks are always present. Not to mention, there is some systemic risk of Dai losing its peg either due to excess demand or faulty oracle updates, as seen March 2020, for example. That said, there are similar “many-sigma” risks in traditional finance — the US Government defaulting on its obligations, for example — that make the risk-free not perfectly risk-free.

Objective. It is crucial to understand where the DeFi risk-free rate is headed.

"Risk-Free" Rate Looking Backward

Interest rate history. Rates offered on dollar-denominated deposits have been highly variable in DeFi lending protocols for their short history and will continue to be. However, APY on deposits have been structurally high: rates are often >5% annualized.

Across venues. Annualized yields have tracked fairly closely across protocols since inception. In particular, Compound and Aave rates tend to track fairly closely. Yearn has offered better rates since inception, likely due to higher assessed risk and lower consumer education and exposure.

As expected, there is also a rate interplay between the protocols: when Yearn launched in Summer 2020, the high yield on Dai and USDC in Yearn forced deposit APYs on Aave and Compound upward. This was due to arbitrageurs rushing in to borrow Dai/USDC from Compound/Aave to deposit in Yearn, capturing the spread. It quickly became a crowded trade, causing rates on Compound/Aave to skyrocket while returns on Yearn fell. When the trade became unprofitable, deposit rates on Aave and Compound returned to single-digits.

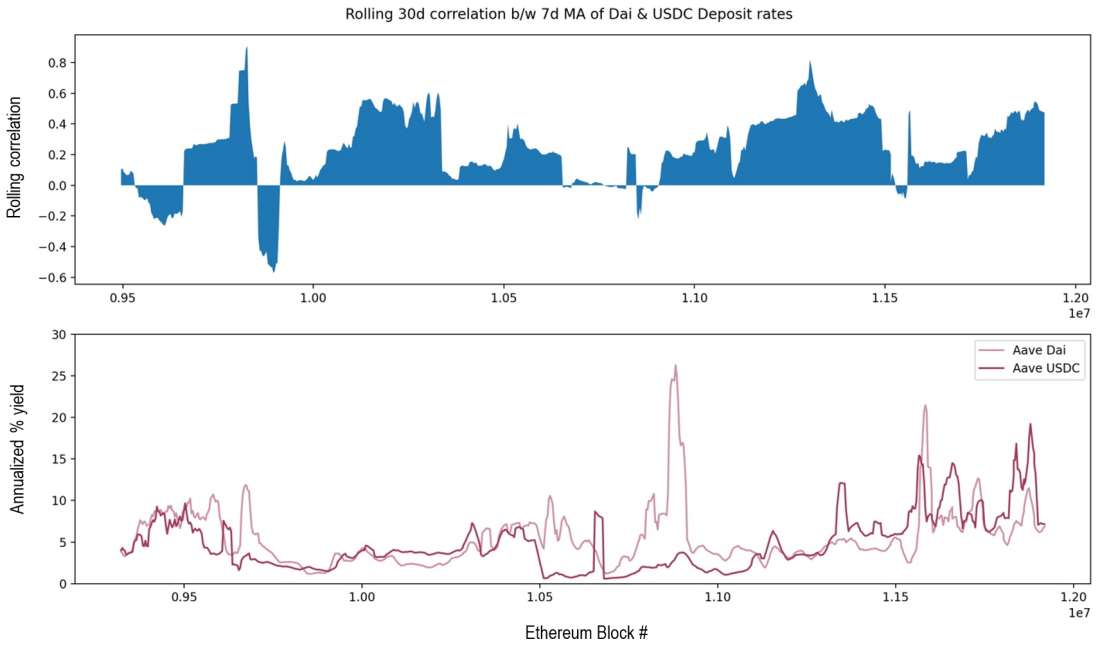

Across stablecoins. Comparative analysis of stablecoin deposit APYs generates insights, too. Yields on Dai in Aave do not track perfectly to USDC yields and they don’t move in perfect tandem. Ad hoc opportunities pertaining to a particular stablecoin can force it out of line with peer stablecoins. However, there is also general coherence to stablecoin rates: the correlation b/w 7d Moving Average of Dai and USDC yields on Aave has hovered around 0.4 and gone as high as 0.8.

(Note: we use moving averages because block-by-block rates offered by lending protocols can be noisy.)

The clear relationship between USDC and Dai deposit APYs on Aave indicates an underlying structural condition being inflicted upon both. No surprises here: demand for the Dollar drives this. But where is the on-chain demand for Dollar coming from?

Basis trade driving demand. The so-called “basis trade” is common in both crypto and traditional markets: sell futures and buy spot, or vice versa. It’s a risk neutral strategy that captures the spread between Futures prices and spot prices, as they eventually collapse into the same price at the future’s expiry. It is not uncommon to see basis rates >30% in crypto, as bullish future projections bring more leverage to Futures contracts.

The basis trade is deep in crypto: a lot of capital is being deployed to capturing the basis spread, but it persists because the bullishness within crypto is so strong. It is a powerful force in the markets. As a result, there seems to be an intimate structural relationship between basis rates and deposit APYs in on-chain lending protocols — imagine it like basis is “pulling up” lending APYs. Mechanically, this suggests that participants could be borrowing on-chain to conduct the basis trade on Deribit plus a spot exchange. The relationship could also be indirect: both basis rates and on-chain deposit rates are indicative of greater leverage in crypto markets but may have no mechanical correspondence.

The first chart below shows the annualized yields of basis and Aave aUSDC (and their correlation). The second chart shows the Z-Score of the annualized yields since block 10,000,000 — (Look how the Z-Scores weave around one another since block 11,000,000):

(Note: Z-Score is taken over the entire period block 10,000,000 – block 12,000,000.)

To summarize, we believe basis rates are a long-term structural contributor to deposit APYs on on-chain money markets. It is very clear that basis has played a major long-term, structural role in on-chain lending interest rates, particularly since block 11,000,000 (October 2020). The deep Basis trade is pulling deposit APYs up.

Conclusion. Identifying likely courses of adoption for DeFi relies on understanding the deposit APY on secured loans in Compound and Aave. If the “risk-free” rate is high, consumers with dollar savings will be incentivized to bring dollar liquidity into DeFi through well-crafted consumer products (in some cases, the end-user may not realize where their high yields are coming from). If the risk-free rate is low, this group of consumers will be less incentivized.

On the other hand, if the risk-free rate is low, real-world borrowers of dollars can get cheap interest rates by tapping into DeFi liquidity, growing adoption with new capital demand. This demand can come from sources who are unable to get cheap financing from major banks.

Finding equilibrium between these courses of adoption depends on the internal dynamics of the rate itself — there is no Federal Reserve to set the Fed Funds Rate. As we showed, one major contributor now and going forward will be the spread on the Basis trade. Shorter-term contributors will be yield-farming opportunities (customer acquisition strategies at scale). In the very long-term, it’s possible that dollar-denominated stablecoins become less relevant in the on-chain economy, and ETH, Rai, or even a decentralized cross-chain BTC could become the de facto medium. Either way, as investors, these dynamics are “like water” in this ecosystem.

References to the “Risk-Free Rate” Does Not Equate to Limited Investment Risk

The risk-free rate of return refers to the theoretical rate of return of an investment with zero risk. In practice, the risk-free rate of return does not truly exist, as every investment carries at least a small amount of risk. The following are some, but not all, risks applicable to DeFi. An investor should perform his or her own diligence regarding all risks before investing.

DeFi Investing Risks. Decentralized Finance (or “DeFi”) refers to a variety of blockchain-based applications or protocols that provide for peer-to-peer financial services using smart contracts and other technology rather than such services being offered by central intermediaries. Common DeFi applications include borrowing/lending Digital Assets and providing liquidity or market making in Digital Assets. Because DeFi applications rely on smart contracts, any errors, bugs, or vulnerabilities in smart contracts used in connection with DeFi activities may adversely affect such activities. DeFi lending is subject to counterparty risk and credit risk, but because lending is automated through the DeFi protocol, rather than individual decisions made by an adviser on behalf of an investor, such risks may be exacerbated, particularly if there are flaws in DeFi protocol’s code or operation. Additionally, some smart contracts operate on open-source protocols maintained by groups of core developers. The open-source structure of these network protocols means that certain core developers and other contributors may not be compensated, either directly or indirectly, for their contributions to maintaining and developing the network protocol. Lack of incentives, or a failure to properly, monitor and upgrade network protocol could damage a DeFi network. It is also possible that a DeFi protocol has undiscovered flaws that could result in the loss of some or all assets of an investor. Furthermore, there may also be network-scale attacks against a protocol, which could result in the loss of some or all of an investment’s values. Accordingly, an investor’s use of DeFi applications may be subject to more risks than engaging in similar activities through regulated financial intermediaries.

Regulation. DeFi applications may involve regulated financial products or regulated activities, however because of their decentralized nature, there is generally no entity subject to regulatory supervision. In addition, in certain decentralized protocols, it may be difficult or impossible to verify the identity of a transaction counterparty necessary to comply with any applicable anti-money laundering, countering the financing of terrorism, or sanctions regulations or controls. If any DeFi protocol’s token is determined to be a “security” under U.S. federal or state securities laws or the protocol itself is determined to be operating illegally, it may have material adverse consequences for an investment. Ongoing and future regulatory actions may alter, perhaps to a materially adverse extent, the value of an investment.

Legal Disclosure:

This document, and the information contained herein, has been provided to you by Galaxy Digital Holdings LP and its affiliates (“Galaxy Digital”) solely for informational purposes. This document may not be reproduced or redistributed in whole or in part, in any format, without the express written approval of Galaxy Digital. Neither the information, nor any opinion contained in this document, constitutes an offer to buy or sell, or a solicitation of an offer to buy or sell, any advisory services, securities, futures, options or other financial instruments or to participate in any advisory services or trading strategy. Nothing contained in this document constitutes investment, legal or tax advice or is an endorsem*nt of any of the stablecoins mentioned herein. You should make your own investigations and evaluations of the information herein. Any decisions based on information contained in this document are the sole responsibility of the reader. Certain statements in this document reflect Galaxy Digital’s views, estimates, opinions or predictions (which may be based on proprietary models and assumptions, including, in particular, Galaxy Digital’s views on the current and future market for certain digital assets), and there is no guarantee that these views, estimates, opinions or predictions are currently accurate or that they will be ultimately realized. To the extent these assumptions or models are not correct or circ*mstances change, the actual performance may vary substantially from, and be less than, the estimates included herein. None of Galaxy Digital nor any of its affiliates, shareholders, partners, members, directors, officers, management, employees or representatives makes any representation or warranty, express or implied, as to the accuracy or completeness of any of the information or any other information (whether communicated in written or oral form) transmitted or made available to you. Each of the aforementioned parties expressly disclaims any and all liability relating to or resulting from the use of this information. Certain information contained herein (including financial information) has been obtained from published and non-published sources. Such information has not been independently verified by Galaxy Digital and, Galaxy Digital, does not assume responsibility for the accuracy of such information. Affiliates of Galaxy Digital may have owned or may own investments in some of the digital assets and protocols discussed in this document. Except where otherwise indicated, the information in this document is based on matters as they exist as of the date of preparation and not as of any future date, and will not be updated or otherwise revised to reflect information that subsequently becomes available, or circ*mstances existing or changes occurring after the date hereof. This document provides links to other Websites that we think might be of interest to you. Please note that when you click on one of these links, you may be moving to a provider’s website that is not associated with Galaxy Digital. These linked sites and their providers are not controlled by us, and we are not responsible for the contents or the proper operation of any linked site. The inclusion of any link does not imply our endorsem*nt or our adoption of the statements therein. We encourage you to read the terms of use and privacy statements of these linked sites as their policies may differ from ours. The foregoing does not constitute a “research report” as defined by FINRA Rule 2241 or a “debt research report” as defined by FINRA Rule 2242 and was not prepared by Galaxy Digital Partners LLC. For all inquiries, please email [emailprotected]. ©Copyright Galaxy Digital Holdings LP 2022. All rights reserved.