Most people who are looking for millionaire-makers -- stocks that can dramatically change your financial trajectory -- seek speculative lottery tickets, like the stock tip your Uncle Jim bragged about at the dinner table during Christmas.

While lightning occasionally strikes, most millionaire-makers are boring but successful companies that grow earnings for decades, often sharing profits with shareholders via dividends.

The businesses behind these fabulous stocks aren't growing by leaps and bounds but will reliably grow between 6% and 10% in a year. Their decades of consistent growth and dividends add up to big returns.

Consumer products stocks can make you rich

Consumers make the economy go round. There are more than 8 billion people in the world. Do you want to strike it rich? Find companies that sell a product which people all over the world buy again and again.

Look for essential products -- things people will buy whether the economy is doing well or not. These are products that consumers pull out their wallets and purses for without even thinking about it. Find as many of these stocks as possible and stuff them into a diversified portfolio.

Buy a little at a time, and sit on your investment. It will take a while for that snowball to grow, but when it does, you'll be rewarded. Here are five magnificent millionaire-making consumer stocks with the goods to continue minting millionaires.

1. Coca-Cola

Global beverage giant The Coca-Cola Company (NYSE: KO) sells hundreds of brands of soda, water, juice, tea, coffee, and more to virtually every country. The business has steadily grown since the brand-name soda was invented in the late 1800s. Over the past 50 years, a starting $10,000 investment will have turned into over $1 million had you done nothing but reinvest the dividends to buy more stock.

The company has raised its dividend for 61 consecutive years, a streak that will likely continue thanks to a centuries-old recipe for success: population growth, price increases, and launching (or acquiring) new product brands. As long as people drink beverages, Coca-Cola should remain as relevant as it always has.

2. McDonald's

You can't tell America's story without acknowledging how McDonald's (NYSE: MCD)established fast food as a cultural staple and disrupted the restaurant business with its real-estate-centric franchising business model. There are more than 40,000 McDonald's locations worldwide today. The company doesn't own the vast majority of them. Instead, it leases the land to restaurant owners, generating reliable profits from the rent and royalties.

Decades of adding restaurants and raising the company's dividend for the past 48 years have made McDonald's a remarkable investment. Had you bought and held $10,000 in stock, it would have grown to over $11 million over its lifetime. As a symbol of Americana, there's no reason McDonald's can't keep serving up stellar investment returns for decades to come.

3. Procter & Gamble

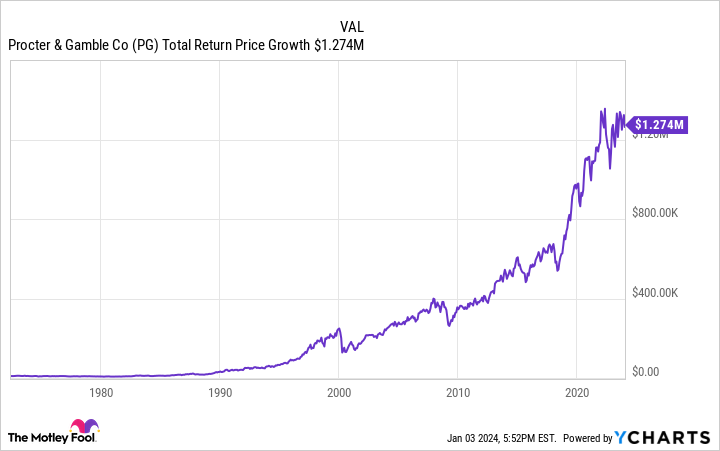

Look at the label on the soap in your bathroom, the toothpaste you brush with, or the shampoo you shower with every day. There's a solid chance you'll find Procter & Gamble (NYSE: PG) somewhere. The company's a conglomerate of household products, home to brands like Tide, Charmin, Gillette, Old Spice, Dawn, Cascade, Febreze, and many more. Consumers stash these household brand products and mindlessly replace them when they run out. Procter & Gamble has been doing this since 1837.

Again, it took many decades, but Procter & Gamble has treated investors well. Investing $10,000 decades ago would have made you a millionaire today, growing to more than $1.2 million with dividends reinvested. Management has given shareholders 67 consecutive raises, and there's no reason to think it will stop. The formula of selling thousands of products to billions of people (while slowly raising the price) has proven very effective.

4. Hershey

Everyone loves a guilty pleasure like chocolate. That largely explains how The Hershey Company (NYSE: HSY) has turned a $10,000 investment into more than $4.6 million after decades of growth and dividends. Hershey is America's leading chocolate company, behind household favorites like Hershey's Chocolate Bar, Reese's Peanut Butter Cups, Kit Kat, Hershey's Kisses, and Twizzlers.

It's the youngest dividend stock on this list. The company has raised its payout for the past 14 years and counting. Chocolate and candy built Hershey's into the confectionary empire it is today. However, creativity in recent years could mean an even brighter future. The company has begun leaning into the salty snacks category, crossing sweets with savory to find new growth opportunities.

5. PepsiCo

If there are any companies to challenge Coca-Cola in the beverage space, arch-rival PepsiCo (NASDAQ: PEP) would be it. PepsiCo's history goes back almost as far as Coca-Cola's. However, PepsiCo has thrived as a dual threat. It boasts a variety of beverage and snack brands, including Pepsi, Gatorade, Lay's, Quaker Oats, Doritos, Lipton, and more.

Like the other four stocks on this list, simply buying, holding, and reinvesting dividends (51 years of dividend growth) has paid handsomely. An initial $10,000 investment will have grown to nearly $2.5 million over PepsiCo's lifetime as a public company. People will always eat and drink, so until they no longer enjoy the delicious products sprinkled throughout your typical neighborhood grocery store, PepsiCo isn't going anywhere.

Should you invest $1,000 in Coca-Cola right now?

Before you buy stock in Coca-Cola, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now... and Coca-Cola wasn't one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of December 18, 2023

Justin Pope has no position in any of the stocks mentioned. The Motley Fool recommends Hershey and recommends the following options: long January 2024 $47.50 calls on Coca-Cola. The Motley Fool has a disclosure policy.

5 Magnificent Stocks That Have Created Many Millionaires, and Will Continue to Make More was originally published by The Motley Fool